Usually, when your arm itches, you simply scratch it a little bit with the tip of your finger and are fine a few minutes later. You simply move on and don’t even think about it. Unless it keeps itching and starts to drive you crazy. At what point would you “give-up” and jump in your car to go to the drugstore to get something strong to calm the itch?

This is about the same thing that could happen in your portfolio with underperforming stocks. Sometimes, you have 1 or more stocks that are not performing at the level you want. Surely it bugs you. But if your overall portfolio is doing well and you don’t lose too much with this particular stock, you may ignore the “problem” and get back to your life. But at one point, you will have to take care of it if the stock continues to drop. But when is the right time to get rid of an underperforming stock?

Do you use a specific metric to trigger your transaction such as Dividend payout ratio, ROE, sales or revenue growth?

Do you put stop sell at a specific price to avoid losing more than X%?

I have a more complex system to determine if I should sell a stock. I personally prefer doing a “case by case” scenario. This means that, once in a while, I stop what I am doing and pull out the numbers and look at the “bad guys”. This is when I decide if I should keep or sell the underperforming stocks. Curious about how I do it? Let’s take my current portfolio as an example. You can see my dividend holdings here (note: stocks prices are not often updated…). I currently have 4 major losers in my portfolio. Here’s the list as of Feb 21st:

VNP: -24.44%

BNS: -10.21%

ZWB: -12.73%

HSE: -6.05%

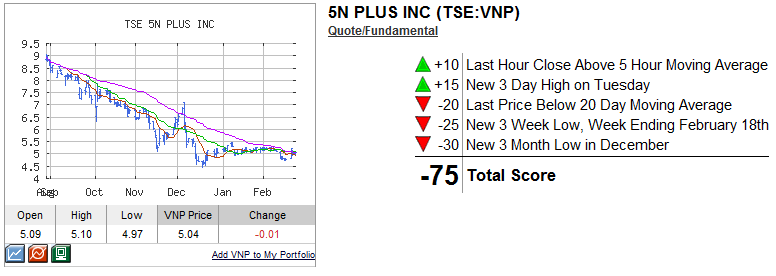

5 N Plus – VNP

The VNP drop in 2011 is a bit of a mystery to me. I agree that the price of rare metals has gone down and that VNP bought a European company during one of their biggest recessions. However, the stock is currently trading at a 9.57 P/E ratio and 6.40 forward P/E ratio. The integration of MCP is going well and their profits are surging. I still believe that rare metals is a great sector and VNP is definitely a leader in their field. I think the stock is very sensitive in regards to any news coming from Europe at the moment. For example, the stock surged 8% on Feb 21st, the same dayGreece settled another step with the Euro.

Decision: VNP is a keeper

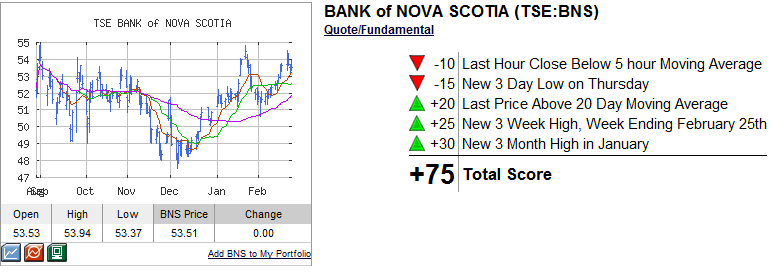

ScotiaBank – BNS

ScotiaBank has been the worst performing Canadian bank in 2011 and by far! I would have been better keeping all my cash in the National Bank (NA) which did great. But I wanted to diversify… I just didn’t pick the right stock for the moment ;-). However, I can’t say thatBNSdidn’t do well in 2011 with a record profit year. All indicators are up and management decided to not increase its dividend to pursue acquisitions. I like this idea since they will use their money to increase the value of the company through profitable projects. So while I’m annoyed by the drop, I’ll keepBNSfor now.

You can get a free Trend Analysis Report on any stocks here.

Decision: BNS is a keeper

Covered Call ETF – ZWB

At first, I thought the idea of a covered call ETF was a sexy addition to my portfolio: the point was to add a solid dividend paying tool that would be linked to Canadian banks. I liked the theory and how it was going to be applied in the real word (basically getting a premium dividend to hold the big 6). However, this was a new product and the theory wasn’t tested on the market. After a year, here’s the result: (click on the image to get a bigger screen):

All right, ZWB lost 10.21%… which is worse than all bank stocks besides BNS(man, I really have a talent to pick bad stocks sometimes ;-)). So I thought “wait! ZWB is paying a killer dividend, so I might be all right!”… wrong! Over the past year, ZWB had paid a total of $1.41/share in dividends (which makes a 8.90% dividend yield on its price of $15.84 a year ago). So the total return over a year was -1.31%… notTOO bad, but not AMAZING either. Especially when I look at individual stock returns.

When I think about it, searching for stability in my portfolio doesn’t make much sense. I’ve already addedJNJand KO for that reason. I think I should pursue more growth instead of trying to hide behind a huge dividend (which had decreased since I bought the stock!). I think I’ll sell ZWB in 2012. It’s just a matter of finding another interesting stock to buy prior to getting rid of the stock. Do you have any suggestions?

You can get a free Trend Analysis Report on any stocks here.

Decision: ZWB is about to get sold!

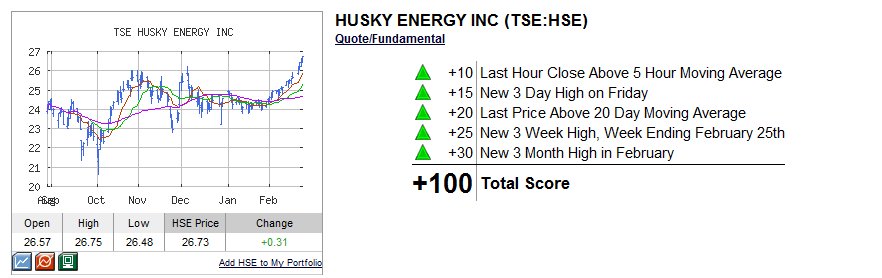

Husky Energy – HSE

Husky has failed to meet financial analyst expectations during the years prior to 2011. It is also true that the rocky oil prices don’t help. However, recent earnings reported early in February are comforting me.HSEshowed a 135% profit increase along with 9% production growth. But they recently announced they were expecting a flat year in 2012. They need to pursue maintenance work on 2 platforms and don’t expect much profit from natural gas. Man… no great news is coming a t all!

Nonetheless, I’ve decided to keepHSEfor 2 reasons.

1) The dividend payout is very high and the dividend payout is sustainable for now (roughly 85%)

2) The P/E ratio is pretty low (currently at 10.92). I’m pretty sure that the stock price won’t go down too much in this situation.

You can get a free Trend Analysis Report on any stocks here.

Decision: HSE is a keeper

Have you cleaned up your portfolio recently?

I’m curious to know what method you use to get rid of your underperforming stocks?